Are you feeling weighed down by debt and looking for ways to break free? You’re not alone. Many people face the challenge of managing debt while trying to save money for the future. But don’t worry, there are smart strategies you can use to tackle your debt and start building your savings. In this post, we’ll explore 17 practical and effective ways to pay off debt and save money.

From creating a budget to negotiating lower interest rates, each method is designed to help you take control of your finances and work towards a debt-free future. It’s important to remember that getting out of debt is a gradual process that requires patience and dedication. But with the right strategies in place, you can start making positive changes to your financial situation.

Whether you’re dealing with credit card debt, student loans, or other financial obligations, these 17 smart ways to pay off debt and save money will provide you with valuable tips and insights to help you achieve financial freedom and stability. So, let’s dive in and explore the ways you can pay off debt and start saving for a brighter financial future.

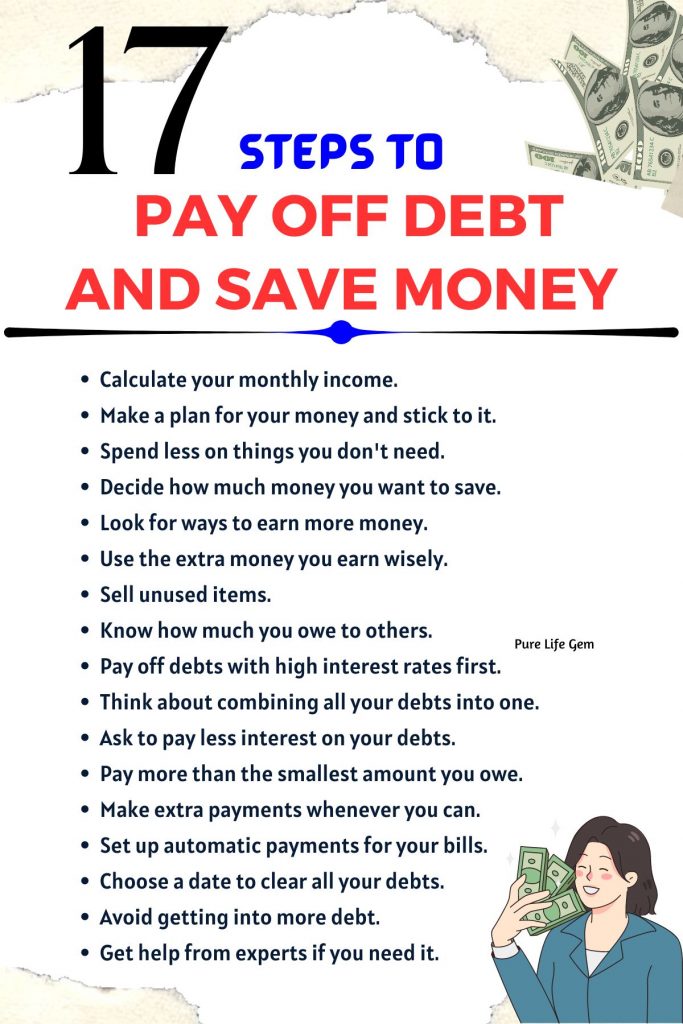

17 Steps To Pay Off Debt And Save Money

1. Calculate Your Monthly Income

Figuring out how much money you make monthly is a smart way to pay off debt and save money. Start by adding up all the income you receive from your job or other sources. Then, subtract any taxes or deductions to get your net monthly income. Knowing exactly how much money you have coming in each month helps you create a budget and plan how much you can allocate toward paying down debt and putting some money aside for savings. By staying organized and aware of your income, you can make better financial decisions and work towards your financial goals more effectively.

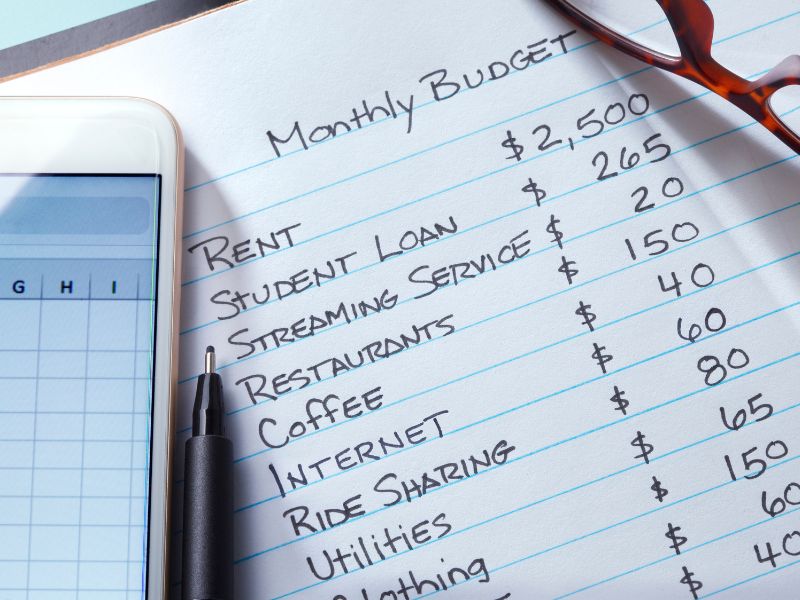

2. Create A Budget And Stick To It

Making a budget and sticking to it is a smart way to pay off debt and save money. First, list all your expenses, like rent, groceries, and bills. Then, subtract these from your income to see how much you have left. Decide how much you want to put toward paying off debt and saving each month, and allocate that money accordingly. Keep an eye on what you spend to ensure you don’t exceed your budget. By creating and sticking to a budget, you can take control of your finances, pay off debt faster, and build up your savings for the future.

3. Cut Unnecessary Expenses

Reducing unnecessary expenses is a smart way to pay off debt and save money. Check how you spend money and find places where you can spend less. This might include eating out less, canceling subscriptions you don’t use, or finding cheaper alternatives for things like groceries or entertainment.

By cutting these extra costs, you can have more money to pay off debt and save. It’s important to be mindful of your spending and try to prioritize your needs over your wants. By making small changes to your daily expenses, you can make a big impact on your financial well-being.

4. Set Savings Goals

Setting savings goals is a smart way to pay off debt and save money. It means deciding how much money you want to save or put towards paying off your debt, and then making a plan to reach that goal. It could be for emergencies, a vacation, or a big purchase. With a plan in place to save a certain amount each month, you can gradually reduce your debt and increase your savings.

Over time, you’ll see your debt decrease and your savings grow, putting you in a stronger financial position. By consistently setting and working towards your savings goals, you can achieve long-term financial stability and security. It’s a simple but effective way to take control of your money and work towards a more secure future.

5. Find Extra Income

Finding extra income is a smart way to pay off debt and save money. It means earning more money on top of your regular income. This extra money can help you pay off your debts faster and start building up your savings. There are many ways to find extra income. You could take on a part-time job, start a side hustle, sell items you no longer need, or provide a service like tutoring or pet sitting.

By bringing in extra money, you can allocate more towards paying off your debts and saving for the future. Paying off debt is important because it can save you money on interest payments and improve your financial situation. It’s a good idea to look for ways to earn more money and be smart with how you use it.

6. Utilize Extra Income

One smart way to pay off debt and save money is by using any extra income you have wisely. This means any money you earn on top of your regular paycheck, like a bonus, gift, or side job earnings. Instead of spending this extra money on unnecessary things, you can put it into paying off your debts.

By doing this, you can reduce the amount of interest you owe and pay off your debts faster. This can also help improve your credit score and financial well-being in the long run. Additionally, you can save money by avoiding paying extra interest on your debts.

7. Sell Unused Items

Selling stuff you don’t need can help you pay off debt and save money. It’s a simple way to earn extra money. Just take a look around your home for things you no longer use or need. Post them online or have a garage sale to make some extra money. Use the money you make to pay off your debts or put it into savings. It’s a smart way to get rid of clutter and improve your financial situation. By getting rid of unused items, you declutter your space and improve your financial situation at the same time.

8. Know What You Owe

Understanding your debts is a smart way to pay them off and save money. Start by making a list of all the money you owe, like credit card balances, loans, and any other debts. Write down how much you owe for each one and the interest rates you’re being charged.

Having this information helps you prioritize which debts to pay off first. You can focus on paying off debts with the highest interest rates or tackle smaller debts first to build progress. By knowing exactly what you owe, you can make a plan to pay off your debts efficiently and start saving money in the long run.

9. Prioritize High-Interest Debts

Focusing on paying off debts with high interest rates is a smart way to save money and become debt-free. Begin by making a list of all your debts and the interest rates attached to each. First, focus on paying off debts with the highest interest rates. By doing this, you’ll reduce the amount of interest you’re paying over time. Once you’ve paid off those high-interest debts, you can put more money towards your other debts or start saving.

By tackling your high-interest debts first, you’ll save money in the long run and get closer to achieving your financial goals. If you have debts with high interest rates, it’s a good idea to focus on paying them off first. This is because high-interest debts can cost you more money in the long run. By prioritizing these debts, you can save money on interest payments and become debt-free faster.

10. Consider Debt Consolidation

Debt consolidation is a smart way to pay off debt by combining multiple debts into one single loan. This can make it easier to manage your debts and reduce the amount of interest you pay overall. With debt consolidation, you make one monthly payment instead of several, which can simplify your finances and help you pay off your debt faster.

However, it’s important to do your research and make sure debt consolidation is the right option for you before making a decision. By considering debt consolidation, you may be able to save money and become debt-free sooner. Consider speaking with a financial advisor to see if debt consolidation is the right option for you.

11. Negotiate Lower Rates

Negotiating for lower rates is a smart way to pay off debt and save money. Contact your lenders and ask if they can reduce your interest rates or fees. Explain your situation and why you’re requesting a lower rate. Sometimes, lenders are willing to work with you, especially if you have a good payment history or if you’re experiencing financial hardship. Lower interest rates mean you’ll pay less in interest over time, helping you pay off your debts faster and save money. So, don’t hesitate to negotiate with your lenders—it could make a big difference in your financial situation.

Related Posts

None found

12. Pay More Than Minimum

Paying more than the minimum amount due is a smart way to pay off debt and save money. Instead of just paying the minimum required each month, try to pay as much as you can afford. By paying more, you reduce the amount of time it takes to pay off your debt and save money on interest charges. Even if it’s just a little extra each month, it can add up over time and help you become debt-free sooner. So, whenever possible, aim to pay more than the minimum—it’s a smart move for your financial future.

13. Make Extra Payments

Making extra payments is a clever way to pay off debt and save money. Whenever you have some extra cash, consider putting it towards your debts. This could be a bonus from work, a tax refund, or money you saved by cutting back on expenses.

By making extra payments, you reduce the principal balance of your debt faster. This means you pay less in interest over time and can become debt-free sooner. Even small extra payments can make a big difference, so try to do it whenever you can. It’s a smart strategy for getting rid of debt and improving your financial situation.

14. Automate Payments

Automating payments is a smart way to pay off debt and save money. Instead of manually paying your bills each month, set up automatic payments from your bank account. This ensures that your bills are paid on time every month, so you avoid late fees. It also helps you stay on track with your debt repayment plan because you don’t have to remember to make payments manually. By automating your payments, you can save time and reduce the risk of missing payments, helping you pay off debt faster and save money on fees. So, consider automating your payments—it’s a smart move for managing your finances efficiently.

15. Establish A Payoff Date

Setting a payoff date is a smart way to pay off debt and save money. Choose a specific date by which you want to have your debt fully paid off. Then, calculate how much you need to pay each month to reach that goal. By establishing a clear deadline, you give yourself a target to work towards.

This can help you stay motivated and focused on paying off your debt. Plus, having a payoff date helps you track your progress and celebrate your achievements along the way. It’s a smart strategy that can help you become debt-free faster and save money on interest charges.

16. Avoid New Debt

Avoiding new debt is a smart way to pay off debt and save money. It means not taking on any additional debt while you’re working to pay off your current debts. To do this, you might need to avoid using credit cards for unnecessary purchases or taking out new loans. Instead, focus on using cash or debit cards for your expenses.

By avoiding new debt, you prevent yourself from falling deeper into debt and can put more money toward paying off what you already owe. This helps you become debt-free faster and saves you money on interest charges in the long run. So, whenever possible, try to avoid taking on new debt—it’s a wise financial move.

17. Seek Professional Help

Getting professional help is a smart way to pay off debt and save money. Consider reaching out to financial advisors or credit counselors who can offer expert advice tailored to your situation. They can help you create a realistic budget, develop a debt repayment plan, and explore options for reducing interest rates or negotiating with creditors. By seeking professional help, you gain valuable guidance and support to manage your finances effectively and achieve your financial goals. It’s a smart move that can save you time, stress, and money in the long run.

Conclusion

Managing debt and saving money may seem difficult, but with the right approach, it’s achievable for anyone. By following these 17 smart strategies, you can take control of your finances, pay off debt faster, and start building a secure financial future.

Remember to stick to your budget, prioritize your debts, and seek help if needed. With determination and discipline, you can overcome financial challenges and pave the way for a brighter tomorrow. Start implementing these tips today and watch as your debt decreases and your savings grow.